Enhance your member services with our advanced bespoke intelligent AI Assistant

Available 24/7 to provide quick, personalised member support, our advanced generative AI chatbots are designed to enhance your member service, enabling you to focus staff on growing your mutual.

- ✓ Free demo

- ✓ Prototype AI Chatbot based on your website

CU Chat Features

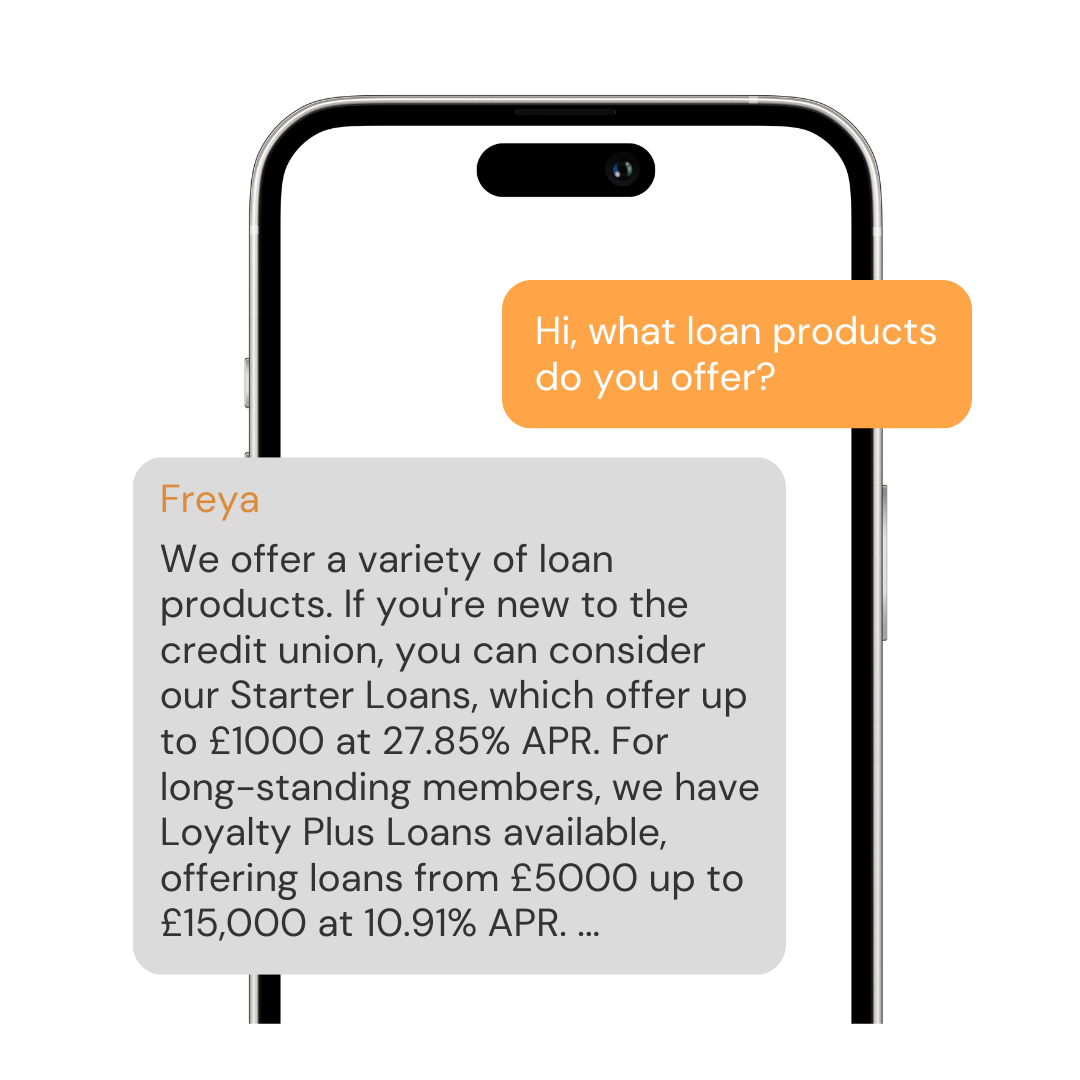

By using advanced AI and Large Language Models like GPT for credit unions, CU Chat is able to learn everything it needs to know about your mutual and provide a personalised response to members, every time.

Free Up Phone Lines

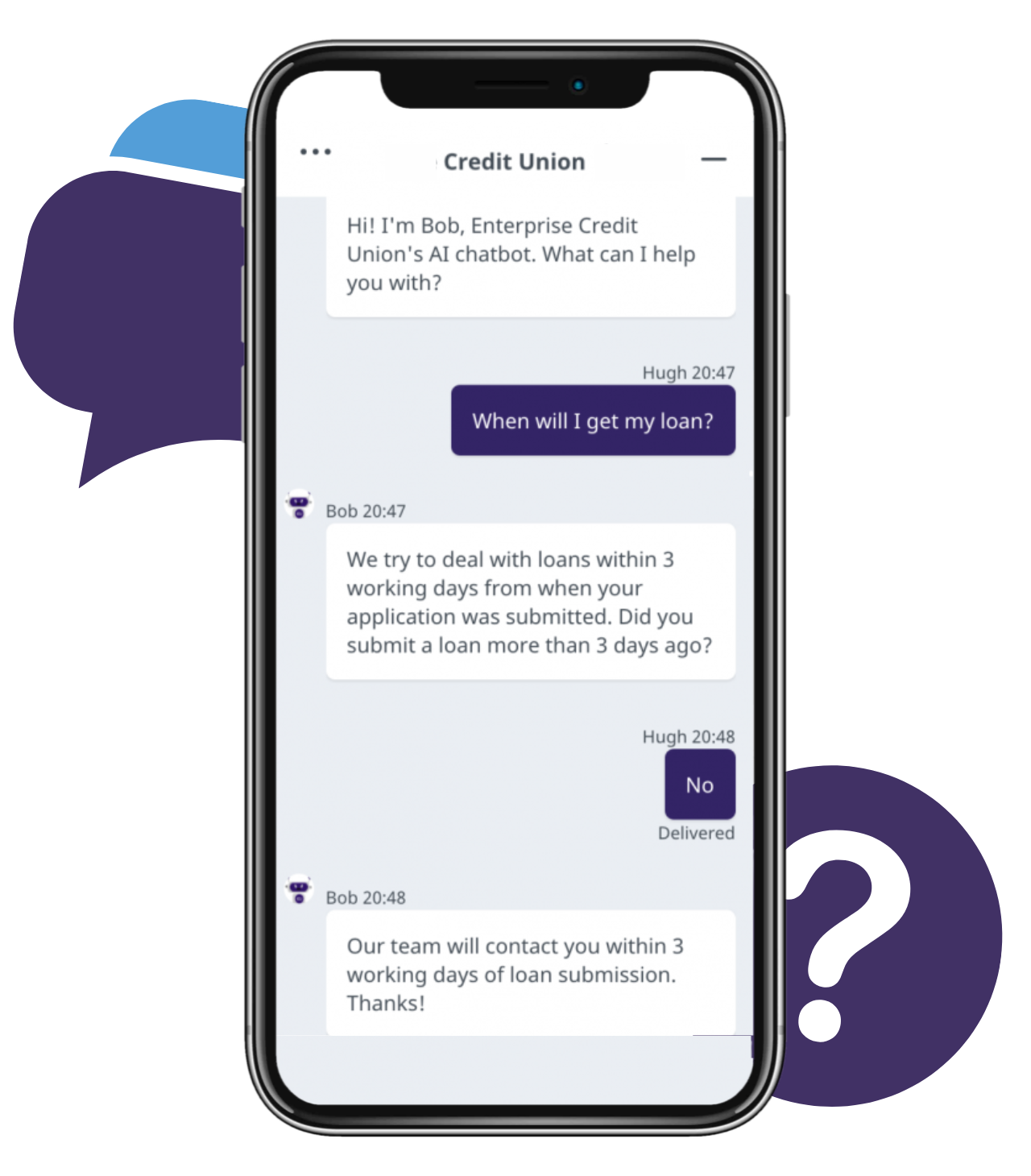

Chatbots are excellent at handling time-consuming simple and frequently asked questions members often phone their credit union about. Unlike NLPs that sometimes struggle with context, our chatbots create an additional reliable channel for members to easily get information which frees up phone lines for staff to handle more complex member queries and situations.

Bespoke colours and branding

All colours, chatbot names, icons, including your loans and savings products, and branch details are bespoke to each mutual. If you have specific queries unique to your mutual, we can add these too. Bespoke branding ensures a consistent and smooth user experience when navigating from your social media or website to engaging with the chatbot.

24/7 access to information

Today members expect answers and responses 24/7. With our advanced generative AI chatbot, this is easy and quick for mutuals to achieve. Your chatbot allows you to reply instantly to member queries at all times and, in many cases, will be able to fully resolve the member's query. When not, it helps the members understand what steps to take next.

Talk to us and Get started with CU Chat

Step 1: Book a demo

Allow us to show you the features that are enhancing the customer service experience for other Mutuals and how it can help yours.

Step 2: Customise your chatbot

From loan calculation features to naming your chatbot, we'll customise your chatbot to your needs.

Step 3: Grow your Mutual with 24/7 support

Once launched, you'll be able to redeploy staff, focussed on building your member base and increasing revenue.

Trusted By